The United States Department of the Treasury’s report, titled “Macroeconomic and Exchange Rate Policies of Major Trading Partners,” released on the 5th (local time), highlights the reasons for maintaining South Korea’s status as a currency monitoring country. The report offers a detailed analysis of the structural changes across South Korea’s macroeconomy, presenting criteria for maintaining its status such as growth slowdown, the weakening of the won, expansion of trade surplus, and foreign exchange market interventions.

South Korea’s real Gross Domestic Product (GDP) only increased by 2.0% in 2024, and in the first quarter of 2025, it decreased by 0.1% compared to the same period the previous year. The report indicates that domestic political instability and uncertainty in the global trading environment have subdued consumer and business sentiment. Consequently, the International Monetary Fund (IMF) has lowered its 2025 growth forecast for South Korea from 2.0% to 1.0%.

In response to the economic slowdown, the Bank of Korea lowered the base interest rate by 0.25 percentage points twice, in November 2024 and February 2025, reducing it to 2.75%. During the same period, the consumer price inflation rate slowed from 3.2% at the end of 2023 to 1.9% at the end of 2024.

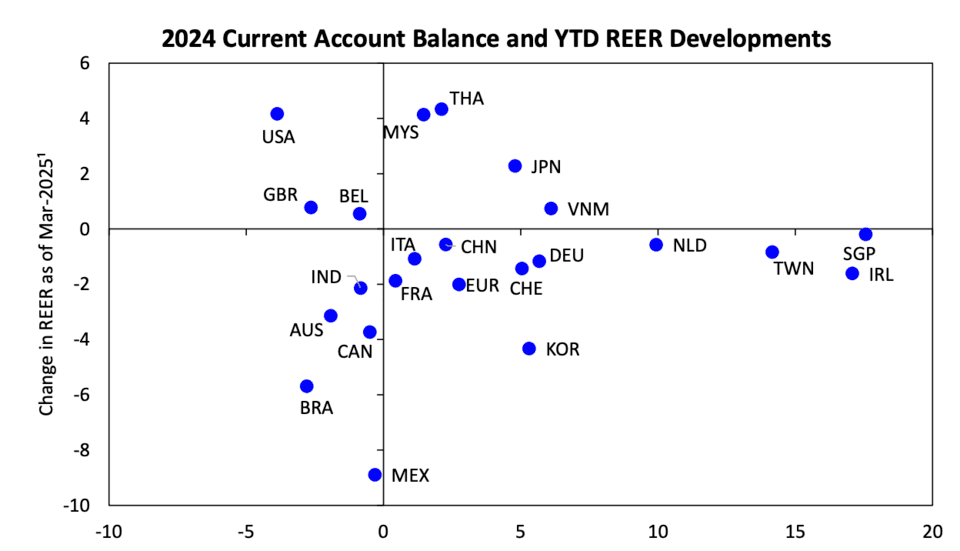

Trade balance showed a clear trend of improvement. South Korea’s current account surplus in 2024 was 5.3% of GDP, significantly expanding from 1.8% the previous year. The trade surplus, particularly in goods, was a driving force, and the trade surplus with the U.S. in goods and services reached $55 billion, an increase of $14 billion from the previous year.

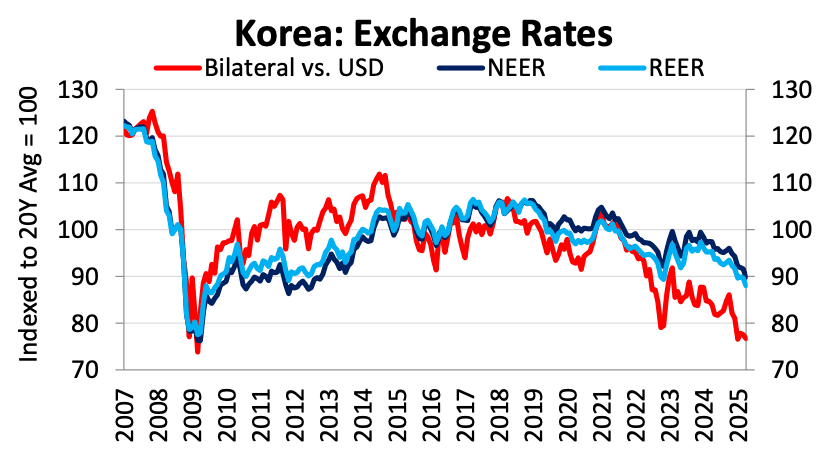

The won depreciated by 12.6% against the dollar throughout 2024, and by 6.7% in terms of the real effective exchange rate. The largest depreciation occurred in April and November. At these times, the won’s value fell to its lowest level since the global financial crisis, reaching 1,480 won per dollar. However, in 2025, the won rebounded by 3.7% from the start of the year due to some political stabilization and external announcements.

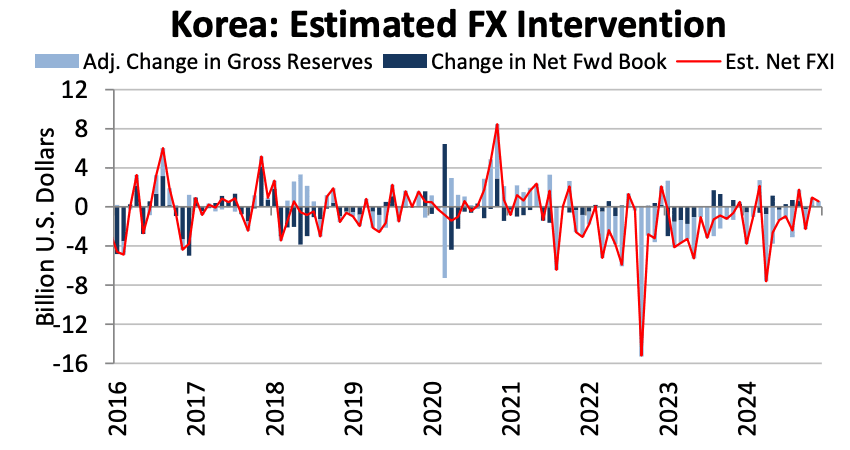

The Department of the Treasury analyzed that South Korean authorities have engaged in two-way interventions to cope with volatility in the foreign exchange market. The total net foreign exchange sales in 2024 amounted to $11.2 billion, equivalent to 0.6% of GDP. Interventions were carried out primarily during April and December when the won was depreciating.

Alongside these measures, the structure of the foreign exchange market was reformed. Foreign financial institutions were allowed direct participation in the domestic foreign exchange market, trading hours were extended, and market infrastructure was enhanced. The report evaluated these initiatives as efforts to improve the efficiency and transparency of the exchange rate market.

The scale of overseas investments by the National Pension Service also increased significantly. As of the end of 2024, the overseas assets managed by the National Pension Service amounted to $470 billion, up by $46 billion from the previous year. Consequently, the monthly forward transaction limit was expanded from $1 billion to $3 billion, and the foreign exchange swap agreement with the Bank of Korea was increased from $50 billion to $65 billion.

The U.S. Department of the Treasury assessed that South Korea met two criteria as a monitoring country: a trade surplus with the United States exceeding $15 billion and a current account surplus exceeding 3% of GDP. However, foreign exchange market interventions did not exceed 2% of GDP, not meeting that criterion.