From February to May 2025, $69.7 billion was concentrated on AI in North America by venture capitalists.

Europe and Asia lacked large investments.

86.2% of the global venture capital (VC) investment in the field of artificial intelligence (AI) was concentrated in North America, centered around the United States, as reported.

According to market research firm PitchBook, $69.7 billion in VC funding flowed into AI and machine learning startups in North America through 1,528 investment deals from February to May 2025. During the same period, Europe had 742 deals amounting to $6.4 billion, and Asia saw 515 deals totaling $3 billion.

The decisive factor for such an inflow of capital into the North American market was OpenAI’s $40 billion investment round. The investment, which took place in March 2025 and was led by Japan’s SoftBank (SB), resulted in OpenAI achieving a company valuation of $300 billion. This valuation is the second largest among private companies globally, following SpaceX’s $350 billion.

The investment will inject $10 billion initially, with an additional $30 billion planned for release by December. However, should OpenAI fail to transition to a commercial structure by year-end, the investment amount could reduce to a minimum of $20 billion. The funds will be utilized for the Stargate project, computing infrastructure expansion, and Artificial General Intelligence (AGI) development.

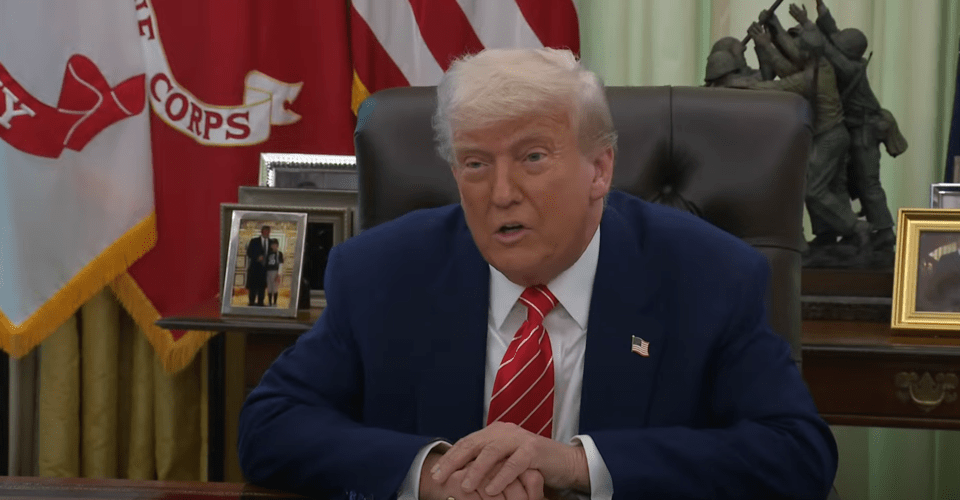

Despite this substantial influx of capital into the North American market, the research environment for AI in the US is gradually shrinking. The Trump administration slashed the budget for the National Institutes of Health (NIH) and the National Science Foundation (NSF) by more than 37% and 50%, respectively. The American Association for the Advancement of Science (AAAS) warned this could “bring an end to America’s scientific leadership.”

Meanwhile, Europe invested €4.6 billion in AI startups during the same period, which accounted for 27.5% of the total venture capital, surpassing the SaaS sector for the first time. Although the European Union (EU) is supporting the AI industry through public funds like Horizon Europe and the EIC Accelerator, there are criticisms of a continued reliance on US capital for large deals due to the absence of super mega rounds.

The situation is similar in Asia. While some promising startups like DeepSeek and Butterfly Effect exist, large investments are challenging due to regulations such as restrictions on importing AI semiconductors.

This year, North America absorbed $69.7 billion out of the total $86.7 billion AI funding, significantly exceeding last year’s 75.6% share. Despite America’s unstable political and financial environment, investors continue to choose the US as it remains the region with the most significant technological innovation outcomes.

As global AI investments concentrate in North America, widening the competitive gap with other countries including South Korea, there is growing concern that Korea’s AI ecosystem may lose its dominance, with technology talents, researchers, and funding increasingly moving in one direction.