The National Tax Service has significantly simplified the income tax filing process for May and is extending support to affected taxpayers.

Starting on the 25th, the National Tax Service began sending mobile notices to 12.85 million individuals subject to comprehensive income tax filing. Individuals with income for the 2024 tax year must file their comprehensive and local income tax returns by June 2.

The “Fill-in” notices, which provide pre-calculated income and tax amounts, were sent to 6.33 million people. Separate refund notices were sent to 4.43 million individuals expected to receive refunds.

Taxpayers who received the ‘Fill-in’ notices can file easily through Hometax, SONTAX, and ARS without additional documents. Hometax and SONTAX will be available from 6 AM to 1 AM during May.

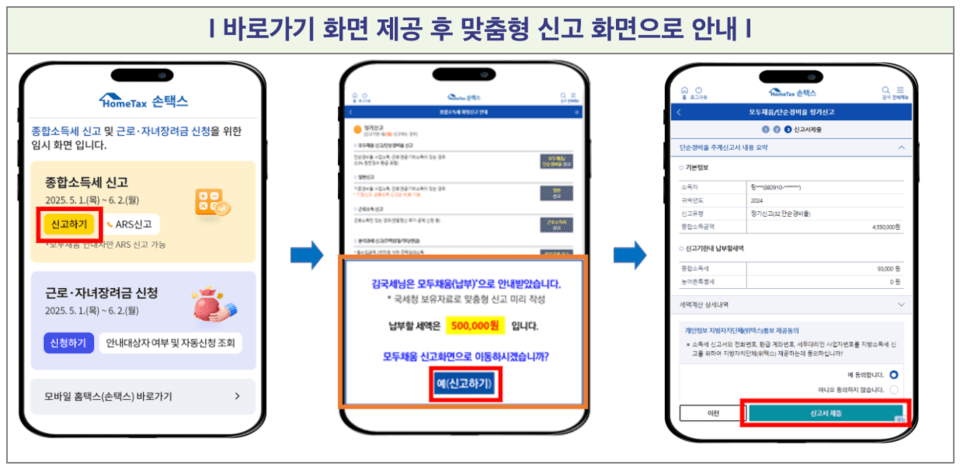

For convenience, the National Tax Service provides a dedicated income tax filing screen, automatically connecting users to a customized filing route to eliminate complex procedures. Taxpayers can move directly to the SONTAX filing screen via mobile notices.

To prevent improper personal deductions, warning messages are provided if someone enters a deceased person or exceeds the income requirement. This measure is intended to preemptively block surcharge burdens due to improper deductions.

The deadline for income tax payment has been extended to September 1 without any separate application for taxpayers in special disaster areas like Sancheong, Gyeongnam, Uiseong, Gyeongbuk, and victims of the Jeju Air accident. The filing deadline has not been extended, and filing within the deadline is mandatory.

Small and medium-sized exporting companies experiencing a decrease in sales will have their payment deadlines automatically extended. Taxpayers can check the extension status via the notice or Hometax.

After filing comprehensive income tax, local income tax is automatically linked to Witax for one-time processing. For those who received ‘Fill-in’ notices, filing is acknowledged with a virtual account payment without accessing Witax.

If the payable tax exceeds 10 million KRW, part of it can be paid in installments within two months. The National Tax Service is also actively considering additional extension applications for taxpayers experiencing business difficulties.

A National Tax Service official stated, “By expanding mobile filings and strengthening tax support, we minimized the burden on taxpayers,” adding, “We will continue to improve taxpayer convenience.”