The Korea Customs Service announced on the 17th that it will conduct special crackdowns on illegal money laundering activities disguising criminal proceeds as using trade and finance, targeting violations of the Foreign Exchange Transactions Act and other relevant laws from November.

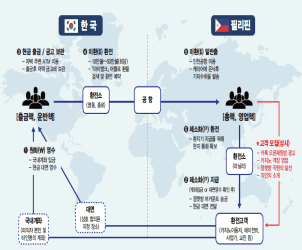

This measure is aimed at blocking the flow of funds for transnational crimes based overseas, such as voice phishing, illegal gambling, and drugs.

Recently, as transnational crimes based in Southeast Asia and other regions have increased, cases of criminal proceeds being moved abroad through methods like offshore currency remittance or carrying foreign currency without reporting are also on the rise. The Korea Customs Service plans to block the distribution of illegal funds at the border to reduce crime damage and weaken the economic foundation of criminal organizations.

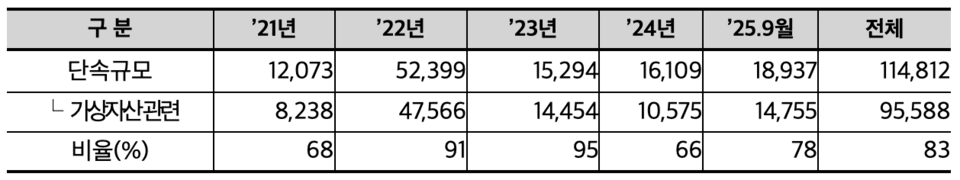

The key areas of this crackdown focus on illegal remittances, smuggling of foreign currency, and trade-based money laundering. Of these, offshore currency remittance is a representative method of illegal remittance, and the scale of crackdowns has exceeded 11 trillion won over the past five years. The proportion of offshore currency remittance involving virtual assets accounts for 83%. The Korea Customs Service will intensively investigate suspects using risk information provided by the Financial Intelligence Unit (FIU) and will also crack down on exchange operators and small remittance operators who engage in business activities beyond their legal scope.

The detection scale for smuggling of foreign currency is on the rise. This year, an organization that carried out 115 billion won of gambling funds abroad was caught. The Korea Customs Service plans to strengthen inspections of travelers departing from certain countries at airports and ports, as well as simultaneously clamp down on the unauthorized entry of counterfeit currency and securities such as checks.

Trade-based money laundering is also a target of the crackdown. Price manipulation and other forms of trade-based money laundering are used to disguise criminal proceeds as legitimate funds, and the scale of crackdowns is also increasing. The Korea Customs Service plans to analyze trade transaction data and overseas cash withdrawal records to identify individuals and corporations with high potential for organizational connection.

To conduct this crackdown, a 126-member ‘Criminal Fund Tracking Team’ led by the head of the foreign exchange investigation department has been formed. Along with the crackdown, administrative investigations will be strengthened and carry-on inspections at airports and ports nationwide will be expanded to block the illegal movement of funds.

The Korea Customs Service will establish cooperative systems with FIU, the Financial Supervisory Service, the Credit Finance Association, and the Airport Corporation to strengthen the sharing of risk information. If crimes under the jurisdiction of other agencies, such as illegal virtual asset transactions or the use of borrowed-name accounts, are identified, they will be immediately notified to prevent blind spots in the crackdown.

Myung-Goo Lee, the Commissioner of the Korea Customs Service, said, “Transnational crimes cause significant damage to the public, so we need to respond with all national capabilities,” adding, “We will strengthen crackdowns to completely block the financial paths of international criminal organizations and contribute to creating a transparent international financial environment.”