The National Tax Service (NTS) has set its sights on tax evasion through irregular and sophisticated real estate transactions. The NTS announced on the 17th that it will launch tax investigations targeting 156 individuals suspected of real estate tax evasion using various methods, including illegal gifts, fake sales, and low-price direct transactions between related parties.

While the real estate market has generally been sluggish recently, preferred areas such as Seoul’s Gangnam district still maintain high prices. The NTS believes that illegal gifts and irregular transactions are flourishing as preferences for specific areas and housing types increase, as evidenced by terms like “Eoljuksin” (preferring new apartments even if freezing to death) and “one smart property.”

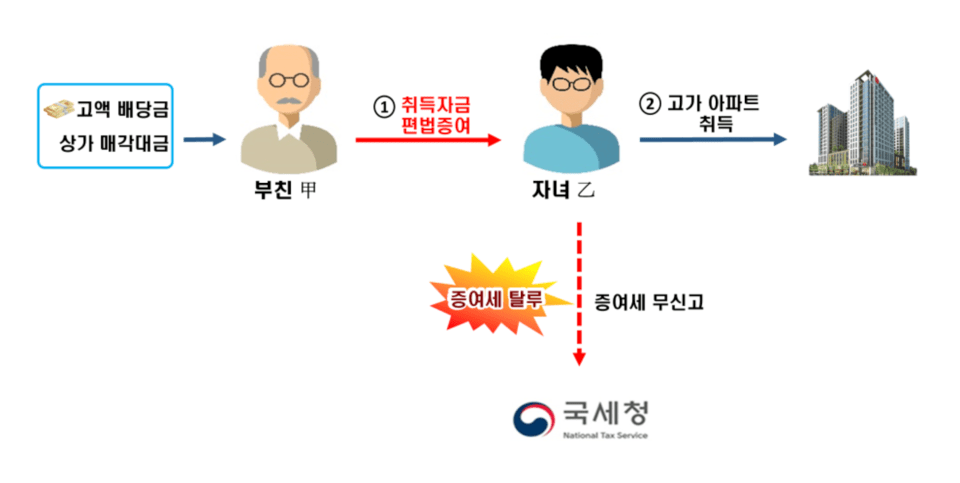

Multiple cases were detected where individuals purchased apartments worth billions of won with parental financial support but failed to report gift taxes. Among the investigation targets, 35 individuals were found to have purchased high-end properties despite their occupations and income levels indicating they couldn’t afford such purchases independently.

In one particular case, a child purchased an ultra-luxury apartment in Gangnam with unclear funding sources. The NTS investigation revealed that the child’s father had received high dividends and sold commercial property just prior, with these funds being used for the apartment purchase. However, no gift tax was reported.

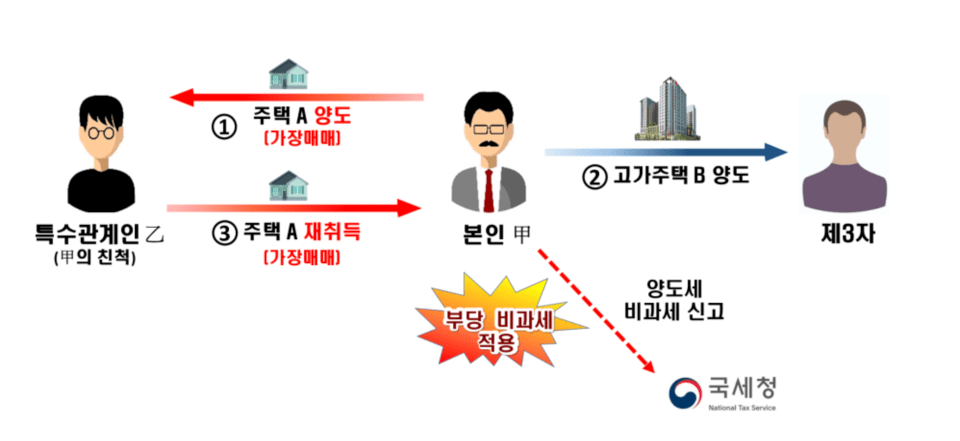

The practice of fake sales, where properties are transferred only on paper to relatives to receive single-home tax exemption benefits, continues to persist. Among 37 cases detected by the NTS, many involved multiple property owners changing the ownership of other properties to relatives’ names before selling properties that had significantly appreciated in value, to qualify for single-home tax exemption benefits.

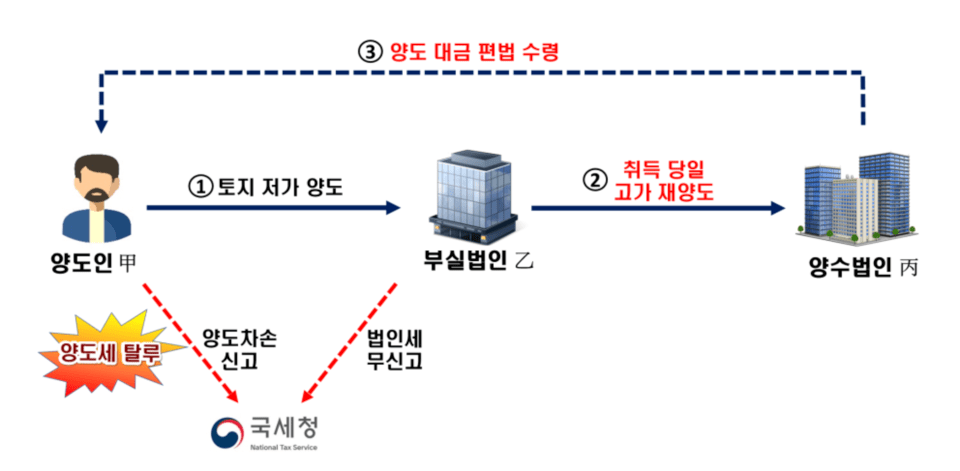

Tax evasion methods using shell companies were also identified. One taxpayer avoided capital gains tax by selling long-held land to a shell company at a low price, which then quickly resold it to actual buyers at a high price. The company did not file tax returns and was found to have been established primarily for tax evasion purposes.

In some preferred areas, numerous cases of underreported contract prices were detected after the lifting of restrictions on pre-sale rights transfers. Investigation targets reduced their capital gains tax by reporting transfer prices lower than actual transaction amounts.

The NTS plans to thoroughly investigate differences between reported prices and actual transaction amounts by analyzing “loss sale” property advertisements and financial transaction records related to pre-sale rights transfers.

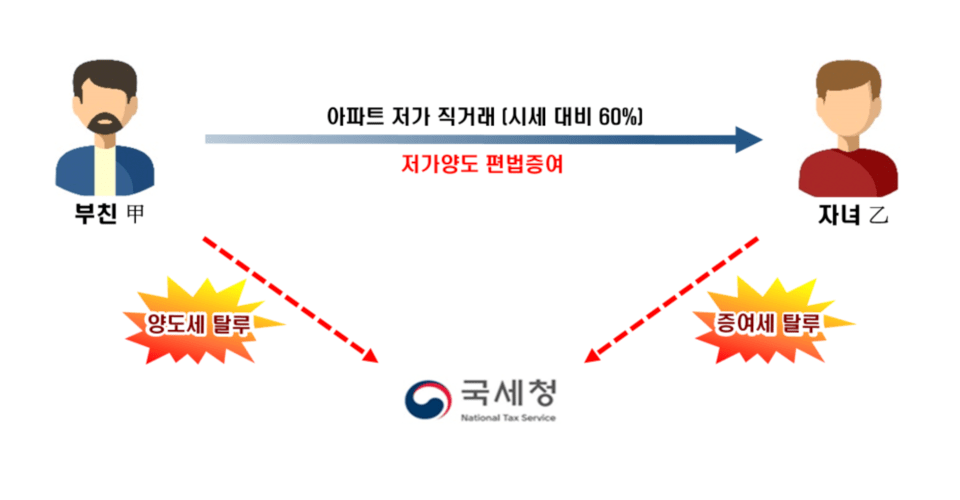

Tax evasion through low-price sales between special related parties such as parents and children or siblings is also under intensive investigation. The NTS detected 29 cases where sellers reduced capital gains tax while buyers avoided gift tax reporting.

In one case, parents directly sold a Gangnam apartment to their child at 60% of market value without reporting gift tax. The NTS plans to recalculate taxes based on market value using transfer tax improper transaction calculations and impose gift tax on the child.

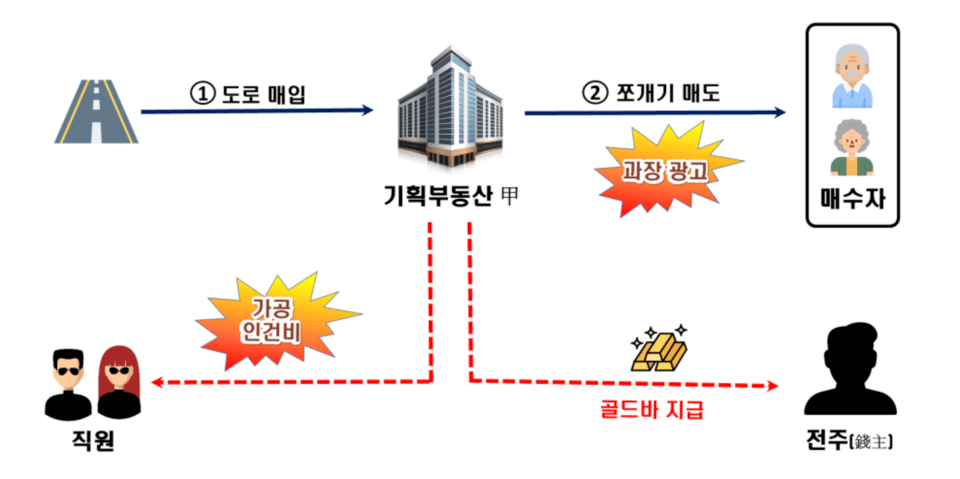

Around planned development areas, planned real estate transactions are active, where companies purchase sites including roads and resell them to investors at high prices after dividing them into shares. Some planned real estate companies under investigation were found to have recruited investors through false advertising, claiming “high compensation upon confirmed development.”

Additionally, suspicions of tax evasion through irregular methods such as recording false labor costs to reduce corporate tax burden and paying cash in gold bars were detected.

The NTS plans to expand tax investigations by closely analyzing transaction-concentrated areas and unusual transaction details. In particular, they aim to establish fair tax order by strictly investigating tax evasion through illegal gifts, down payments, and fake sales, especially in areas with development potential.

An NTS official stated, “We will collect on-site information focusing on areas where transactions are concentrated due to development potential, and thoroughly verify whether tax reporting has been properly conducted during real estate transactions using various taxation infrastructure. If evidence of tax avoidance using irregular and sophisticated methods is confirmed, we will conduct thorough investigations to implement fair tax administration.”

It remains to be seen whether this investigation will effectively eliminate illegal real estate transaction practices.