Transferring money between family members, a common everyday activity, can lead to tax repercussions. Not only gift and inheritance taxes, but also source of funds investigations and large cash transaction reporting are converging to require meticulous preparation for even simple bank transfers.

Particularly this year, with the introduction of a system where tax officials receive a 10% bonus for collected taxes, tax audits are expected to become more stringent.

Transfers from Parents Presumed as Gifts

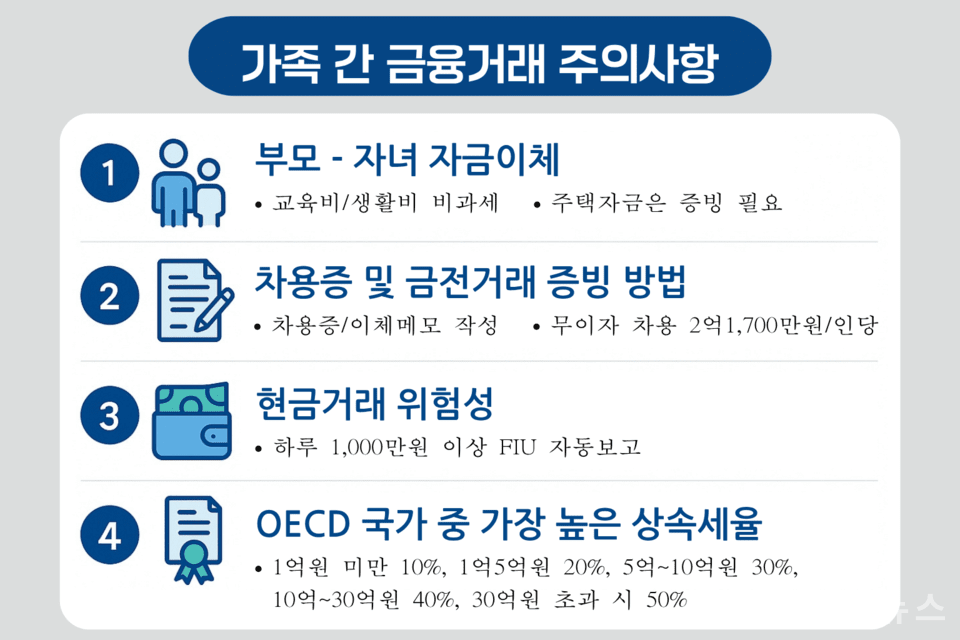

Transferring funds from parents to children is not automatically subject to gift tax. If the purpose is for genuine support such as education or living expenses, it is non-taxable. Notably, even if overseas education expenses accumulate to billions of won, they are tax-exempt.

However, if significant amounts are transferred without clear consumption purposes, such as for home purchase or deposit funds, the National Tax Service initially regards it as a gift. If the taxpayer cannot prove otherwise, they might face a hefty tax bill.

Documentation is crucial. It’s essential to note the purpose in the transfer details, or to save talk messages with parents and receipts for actual expenditures. Without documentation explaining the exact source of funds, it can be disadvantageous during investigations.

Transfers between spouses differ. Generally, everyday expenses or joint spending are not taxed. However, if a non-working spouse uses their partner’s funds to purchase an expensive apartment under joint ownership, gift tax may apply. The tax exemption between spouses is up to 600 million won, but amounts exceeding this are taxable.

Without a Loan Agreement, It’s Regarded as a Gift

Even when claiming to borrow money from parents, it is difficult to get recognized without a signed loan agreement. Particularly, when large funds are involved such as in home purchases, it is crucial to document the loan agreement and keep records of interest payments or principal repayments.

Under current laws, interest-free borrowing is allowed up to 217 million won. Since it applies to individuals, it can allow for borrowing over 400 million won interest-free if both spouses utilize this. By involving both sets of parents, borrowing over 800 million won without interest is feasible.

However, if interest is paid to parents, they will incur income tax on the interest income. While the bank interest income tax rate is 15.4%, personal loans have a tax rate of 27.5%, significantly increasing the tax burden on parents.

Cash Transactions Are Riskier Than Accounts

The belief that cash is safer than accounts in family transactions is a misconception. Cash transactions over 10 million won per day are automatically reported to the Financial Intelligence Unit (FIU) and relayed to the National Tax Service. Recently, transactions exceeding 30 million won are mostly automatically tracked.

Attempting to evade this by depositing into several banks may still lead to reports. If bank staff deem the transactions suspicious, they might report them to the FIU even if they are under 10 million won. Repeated transactions over a certain amount within a short period raise the likelihood of reports significantly.

Inheritance Tax Requires Advanced Preparation

Inheritance tax is not just a wealthy issue. South Korea’s top inheritance tax rate is 50%, the highest among OECD countries. Inheriting even a single apartment in Gangnam could lead to billions in inheritance taxes. Nonetheless, the basic deduction is only 500 million won, bringing more middle-class families into the inheritance tax bracket.

Once inheritance begins, tax structuring cannot be altered. If targeted for tax audit, financial transfers up to 10 years before the decedent’s death are scrutinized. Unreported lifetime gifts may lead to paying nearly double taxes due to penalties and interest.

If parents only possess high-value real estate without financial assets, enrolling in a reverse mortgage can create liabilities that are exempt from the inherited estate.

Moreover, caution is needed with cash withdrawals. Any amount exceeding 500 million won withdrawn within two years prior to death is assumed to have been spent by the heir, thus becoming taxable. This highlights the greater risk posed by cash over accounts.

Tax Audits: Proactive Preparation is Key

Preventive measures are essential for any tax issues. Seeking expert advice before signing contracts, moving funds, or transferring assets is crucial for tax reduction. Tax laws change annually, and the National Tax Service’s audit capabilities continue to advance. Dependence on outdated information from the internet should be replaced by precise and practical judgments.