If you file your income tax return carelessly, you could end up paying much more than originally required. The National Tax Service is enhancing personalized guidance for diligent filing and big data-based filing validation during the comprehensive income tax filing period.

On the 7th, the National Tax Service sent notices with individual filing precautions to 1.19 million taxpayers through mobile. The pre-notification targets were selected based on items with high error potential, including transfer income from patent rights, sales income from business assets, income from overseas platforms, and business-use automobile insurance registrations.

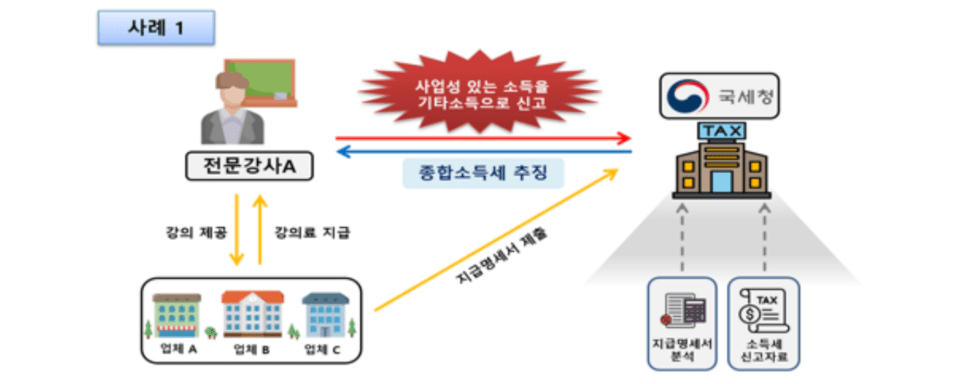

Actual cases prove the importance of diligent filing. Professional instructor A filed her lectures with various companies as other income. However, the National Tax Service judged her lecture activities as business income since they were conducted independently and repeatedly. As a result, A had to amend her comprehensive income tax and pay a penalty tax.

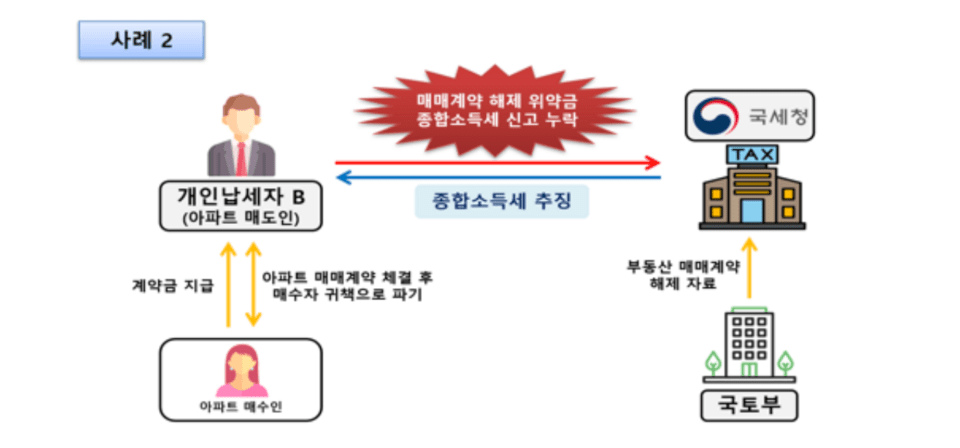

In another instance, individual taxpayer B failed to include compensation received from canceling an apartment sale contract as other income, leading to a levy. The fact that B received the penalty was revealed based on real estate contract data, and the National Tax Service demanded an explanation and prompted a revised filing with a penalty tax.

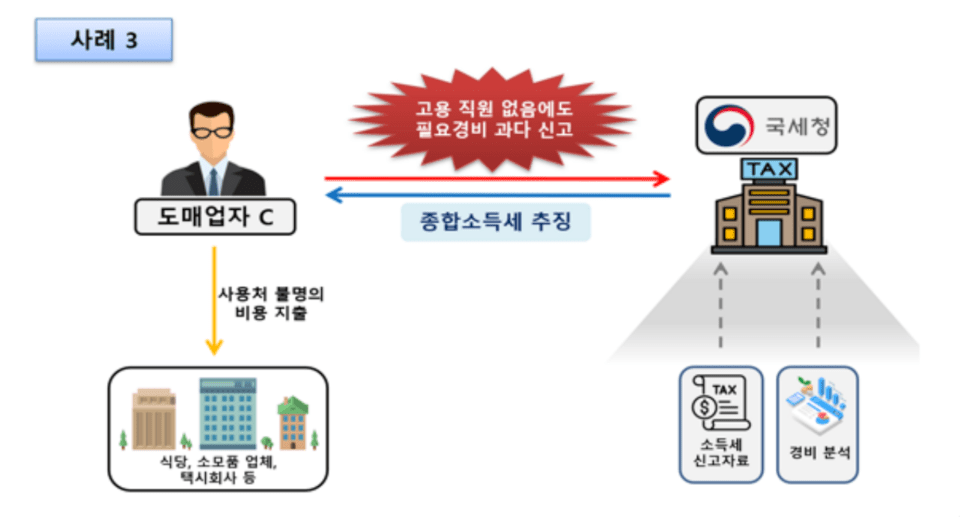

Wholesale business owner C, operating alone without employees, excessively accounted for travel and transportation and employee welfare expenses as necessary expenses. These were in fact unrelated to the business, and the National Tax Service exposed them by analyzing account ledgers and financial transaction data.

To prevent these cases, the National Tax Service has strengthened the ‘Filing Assistance Service.’ By accessing HomeTax and SonTax, taxpayers can view individual income rate analysis, industry-specific sales expense ratios, pre-paid tax amounts, and income deduction items at a glance. Tax agents can also view client taxpayer data, which is highly practical in the field.

The National Tax Service analyzes whether the filing aids were actually applied even after the filing has ended. The results from last year’s validation process showed a number of misfilings even after guidance was given, which was made possible through big data-based analysis.

Diligent filing is more than just fulfilling tax obligations; it is also a tax-saving strategy. To avoid penalty taxes and subsequent audits and corrections, the initial filing must be accurate. The National Tax Service repeatedly emphasizes that diligent filing is the best tax-saving measure.

To reduce filing errors, the National Tax Service provides real-time taxpayer-customized data. Taxpayers can check the contents of their individual diligent filing pre-guidance through the ‘Filing Assistance Service’ on HomeTax and SonTax.