July is the month when property tax bills arrive for those owning real estate and assets. Property tax is imposed on individuals who own particular assets such as land, houses, and buildings, based on a predetermined date each year.

Since 2005, the comprehensive land tax has been consolidated into the property tax, with houses being taxed alongside their appurtenant lands. Previously significant in the tax system, today it functions mainly as a supplementary income tax and a local tax.

The tax assessment date is June 1—this means the actual owner is the taxpayer.

Property tax is charged to the person who actually owns the property as of June 1 each year, known as the ‘tax assessment date’ which determines the taxpayer for the year. For example, if the balance of a real estate sale is paid on June 1 and ownership is transferred, the buyer is taxed for that year. However, if the sale takes place after June 2, the previous owner is liable for the property tax.

Regardless of whether a legal registration has been done, the person who practically owns the asset is the taxpayer. For instance, in the case of an inheritance that has started but not legally registered, the main heir must report to the local government within 15 days from the tax assessment date. If not reported, the tax authority will investigate and tax the actual owner.

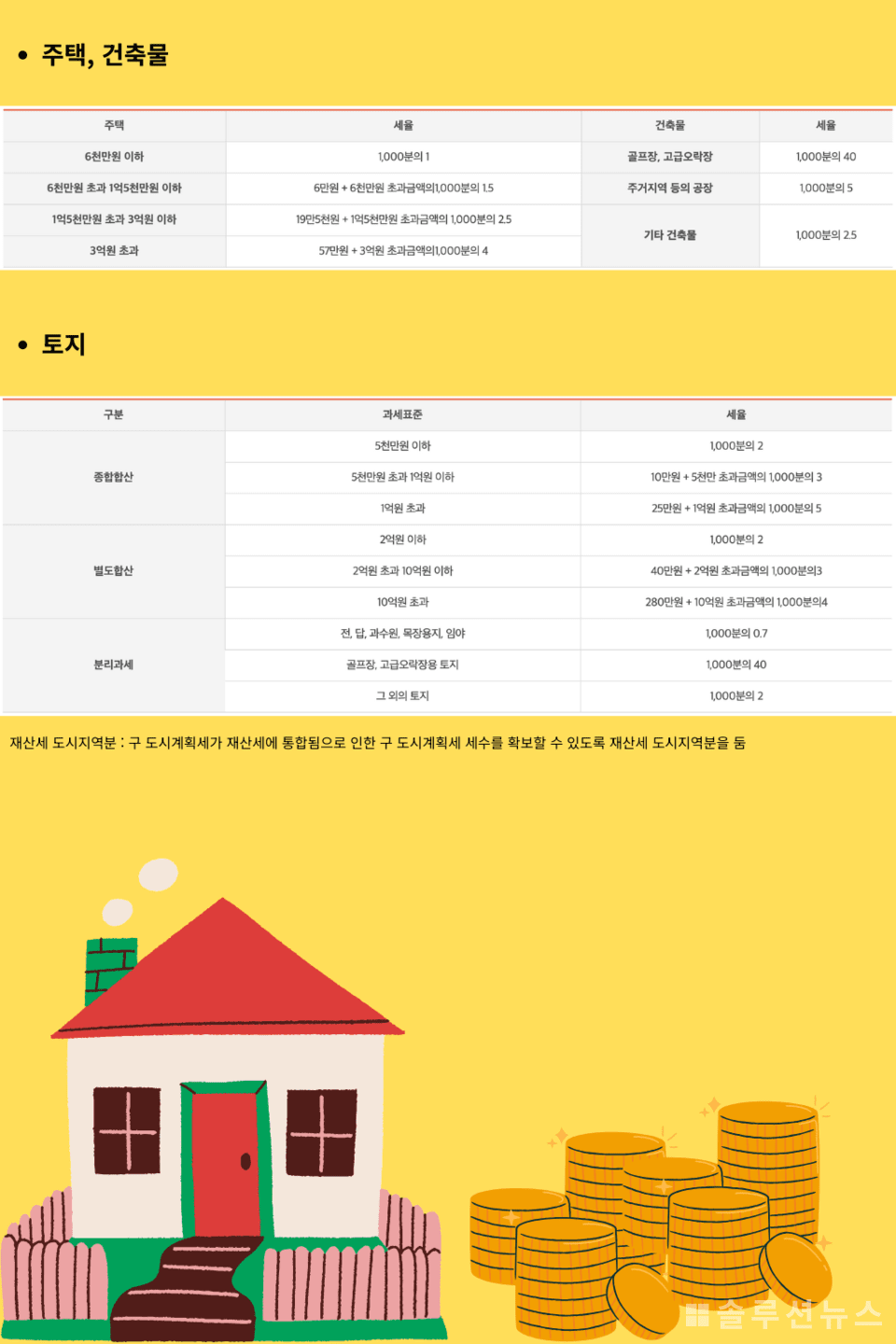

The subjects of taxation include homes, land, buildings, vessels, and aircraft, with the rate differing depending on usage.

The taxable items for property tax include housing, buildings, land, ships, and aircraft. Among these, housing is comprehensively taxed with its appurtenant land. Land is classified into comprehensively assessed, separately assessed, and individually assessed categories based on usage.

For comprehensively assessed land, all land owned nationwide by a taxpayer is combined and taxed at a progressive rate. This mainly applies to land excluded from separately assessed or individually assessed categories, such as barren land or mixed-use land. Owning multiple parcels of comprehensively assessed land can lead to rapidly increasing tax burdens due to the progressive tax rates applied to the combined tax base.

Separately assessed land involves specific lands within a local government’s jurisdiction, such as land associated with general business buildings like offices or shopping malls, which is compounded and taxed at a progressive rate. This classification considers taxation equity for business land.

Individually assessed land applies a proportional tax rate without combining it with other lands. For example, agricultural lands like fields, paddies, orchards, and pastures are taxed at a lower rate (0.07%), supporting agricultural activities. Conversely, luxury properties like golf courses and high-end recreational lands are taxed at a higher rate (4%), to strengthen taxation on luxury properties. Thus, knowing the classification of your land is crucial as taxes can vary greatly depending on its usage and classification.

The fair market value ratio and the official price affect the tax amount.

The taxable base of property tax is calculated by multiplying the asset’s price by the fair market value ratio, which determines the taxable amount among the standard market prices.

For land, 70% of the publicly announced value is applied as the tax base, and for buildings, 70% of the standard market price is used. For housing, the basic ratio is 60% of the house’s public price.

Single-homeowners benefit from a special fair market value ratio to alleviate tax burdens. This temporary provision, effective since 2023, continues this year with 43% applied for public prices up to 300 million won, 44% for prices exceeding 300 million won but under 600 million won, and 45% for prices exceeding 600 million won.

If there is an issue with the publicly announced real estate price, adjustments can be requested through a specified procedure. If it is deemed higher than neighboring properties or similar real estate, an appeal can be submitted to the tax authorities based on actual transaction cases — a practical method to reduce property tax burdens. It is advisable to monitor the public price every 2-3 years and consider lodging objections if necessary.

Payment deadlines are in July and September… late payments incur additional taxes.

Property tax payment schedules differ by taxable item. Housing is split into two installments, with half due in July and the other half in September. Buildings and ships are due in July, while land other than housing is due in September.

For 2025, the first installment must be paid between July 16 and 31, and the second installment between September 16 and 30. If the property tax for housing is 100,000 won or less, it is billed in full in July. Late payments incur additional taxes, so attention is necessary.

Various payment methods… digital transition enhances convenience.

Property tax can be paid both online and offline through systems like WETAX, internet giro, mobile apps, ARS, virtual accounts, bank counters, etc. WETAX also allows payment using credit card points.

Seoul offers payment services through its own systems, ETAX and STAX. Subscribing to electronic delivery or automatic withdrawal provides a tax credit of up to 1,600 won per transaction.

Tax reduction strategies… Utilizing the tax assessment date (June 1).

The property tax assessment date, June 1, is crucial in determining liability, so adjusting the payment date in real estate transactions helps manage property tax burdens wisely.

In selling property, setting the balance payment date before May 31 can pass the tax burden for that year to the buyer. Conversely, when buying, setting the payment date after June 2 ensures the seller pays that year’s property tax.

For newly constructed or reconstructed buildings, the acquisition date is the earlier of the usage approval date (or temporary usage approval) or the actual usage date, so delaying both dates to after June 2 benefits tax reduction.

Tax reduction strategies… Joint ownership and change of use.

While property tax on houses is billed per item, land subject to separate and comprehensive assessment combines the official price of land in municipal areas and applies progressive rates, so joint ownership lowers each person’s taxable base and thus incurs lower progressive rates for property tax reduction. This strategy only applies to combined-assessed land.

In cases where an officetel is used residentially but registered as business use, building property tax may apply. Filing a change of use report with evidence to the district office can switch it to residential property tax. Often, residential property tax on officetels is lower than business use, so changing use can reduce tax burdens.

Single-household homeowner tax deductions (by age, ownership duration).

Single-household homeowners meeting certain conditions can receive property tax deductions up to 80%, designed to alleviate tax burdens for elderly and long-term owners.

Age-based deductions are 20% for 60 and above, 30% for 65 and above, and 40% for 70 and above. Deductions based on ownership period can also apply simultaneously: 20% for 5+ years, 40% for 10+ years, and 50% for 15+ years.

Deferral system for elderly single-household homeowners.

Elderly single-household homeowners experiencing reduced income post-retirement can defer property tax payments. Applicable to those aged 60+ or with properties held for 5+ years meeting certain criteria, applications can be filed.

Conditions are as follows: as of June 1, one must be a single-household homeowner, with total previous year’s salary under 70 million won and combined income tax standard under 60 million won. Property tax or comprehensive real estate tax must exceed 1 million won, and all conditions must be met to apply for deferral.

However, caution is warranted. Becoming a multi-homeowner cancels the deferral immediately, requiring full tax payment at once. During deferral, an annual interest rate of 2.9% applies, necessitating careful long-term benefit assessment of deferment.

Deferral isn’t automatic; applications must be made to the local tax office by three months prior to the notice date, and deferral delays payment but isn’t a tax exemption, so potential interest must be considered.

Starting point for property tax reduction: accurate understanding and preparation within changing policies.

Property tax involves numerous elements such as asset type, ownership form, public price, and tax structure. Adding annual changes like the fair market value ratio, tax base cap, and single-homeowner special provisions often creates confusion for taxpayers.

Real estate policies often change flexibly with administrations and times, leading to varied annual taxes even for the same property. Instead of solely relying on government notices, taxpayers should accurately assess their property situation and actively respond by verifying necessary information themselves.

The more complex the system, the more essential it is to carefully consider basic details to reduce unnecessary tax burdens.