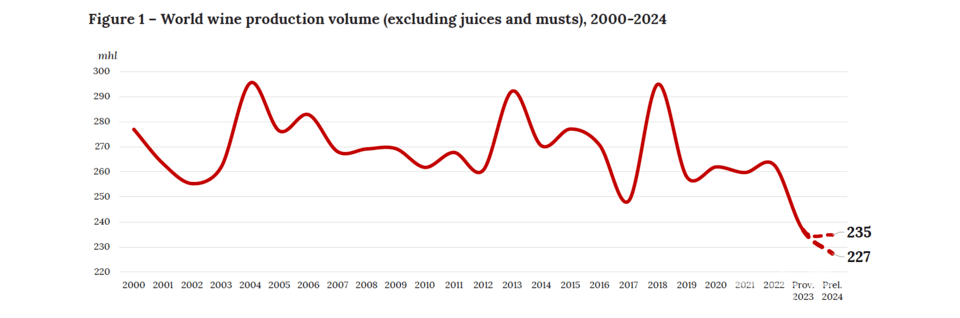

The International Organisation of Vine and Wine (OIV) estimated last year’s global wine production at 226 million to 231 million hectoliters, about a 5% decrease from the previous year, significantly below the average of the last decade.

Weather anomalies such as frost, heavy rain, drought, and floods severely impacted vineyards, reducing yields across both the Northern and Southern Hemispheres, with high-quality production areas being particularly affected.

While production declined, demand also decreased, maintaining a significant balance in the overall market. Global wine exports stood at 99.8 million hectoliters, similar to the previous year, while export value decreased by 0.3% to 36 billion euros. The average export price per liter was 3.60 euros, approximately 30% higher than pre-pandemic levels, driven up by supply reductions and inflation.

Climate change is shaking the very structure of the wine industry. Rising temperatures have advanced the harvest season, causing sugars to mature quickly while acids and tannins do not, leading to an imbalance in grape quality. Additionally, recurring weather risks such as mold, late frost, and hail are worsening cultivation environments.

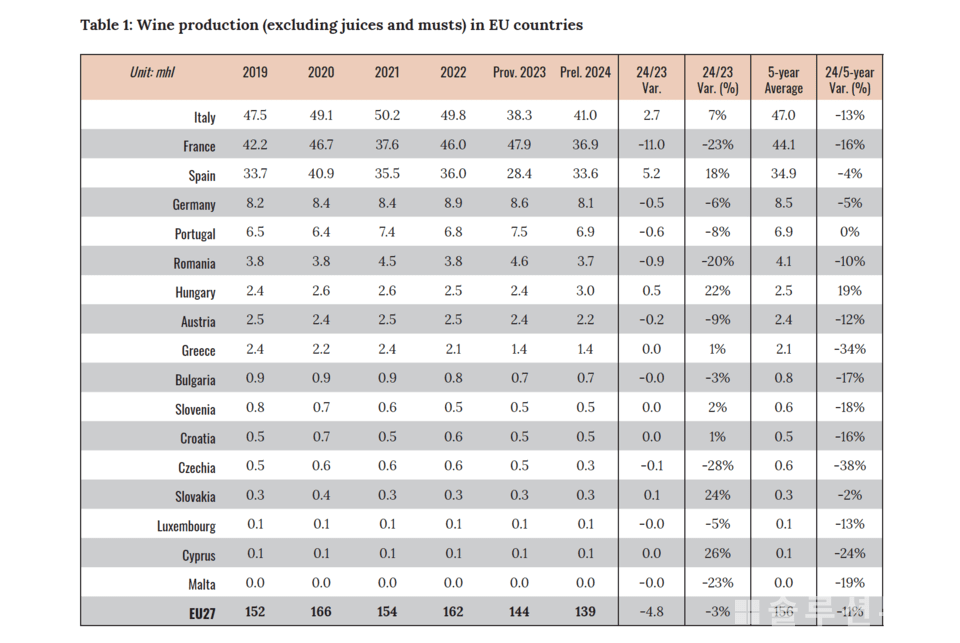

Among countries, France was hit hardest, with a 23% reduction to 36.9 million hectoliters, 16% below the average of the last five years. Romania saw a 20% decline, Austria 9%, and Germany 6%. In contrast, Hungary increased production by 22%, reaching its highest level since 2010.

Italy regained its position as the world’s top wine producer with a production of approximately 41 million hectoliters, a 7% increase from the previous year, despite adverse weather in the northern regions. However, it remains 13% below the average of the last five years, although market confidence appears to have somewhat recovered.

Despite Italy’s relative success, the global wine market continues to languish.

In 2024, global wine consumption dropped by 3.3% from the previous year to 214 million hectoliters, the lowest since 1961. This decline was influenced by a complex mix of factors, including younger generations’ health-conscious consumption trends, reduced purchasing power due to inflation, competition from ready-to-drink products, and decreased consumption among older generations.