It is mandatory for businessmen to report or pay the value-added tax by April 25. However, the problem is that most are confused about whether it’s an ‘anticipated notice’ or an ‘anticipated report’.

Anticipated notice vs. anticipated report

An anticipated notice is when the National Tax Service sends out a notification and the business simply needs to pay the amount. This method is applicable to individual general taxpayers and small corporations with sales less than 1.5 billion won in the previous year. It is not necessary to report separately, but if sales have significantly decreased or if early reimbursement is needed, it’s more beneficial to file an ‘anticipated report’ directly.

An anticipated report is required for corporate businesses of a certain size. They must self-report and pay the value-added tax based on the performance from January 1 to March 31. In the year 2025, about 650,000 corporations are required to comply with this.

Step 1: Confirm the anticipated notice tax amount

Individual businessmen and small corporations can check whether there is a notice and the tax amount through the following methods:

[HomeTax] Tax Report > Value-Added Tax Report > Report Assistance Data Inquiry > Confirm the anticipated notice tax amount

[SonTax] The same menu is also available in the app.

[ARS] 1544-9944 → Dial 5 for ‘Check Value-Added Tax Anticipated Notice’ → Confirm after identity verification

If the anticipated notice tax amount is less than 500,000 won, the notice is skipped this time and should be reported and paid together during the 25.1 final report.

Step 2: HomeTax reporting for anticipated report targets

Corporations must file the anticipated report. The reporting path is as follows:

[(Taxpayer) HomeTax] Tax Report > Value-Added Tax Report > Report Assistance Service

[(Tax Agent) HomeTax] Tax Agent · Tax Management > Common Tax Agent Inquiry > Report Assistance Service

The ‘report assistance data’ provided by the National Tax Service is pre-filled with electronic tax invoices, credit card sales, and purchase data. You just need to verify the information and add any missing items.

Step 3: Convenient payment completion

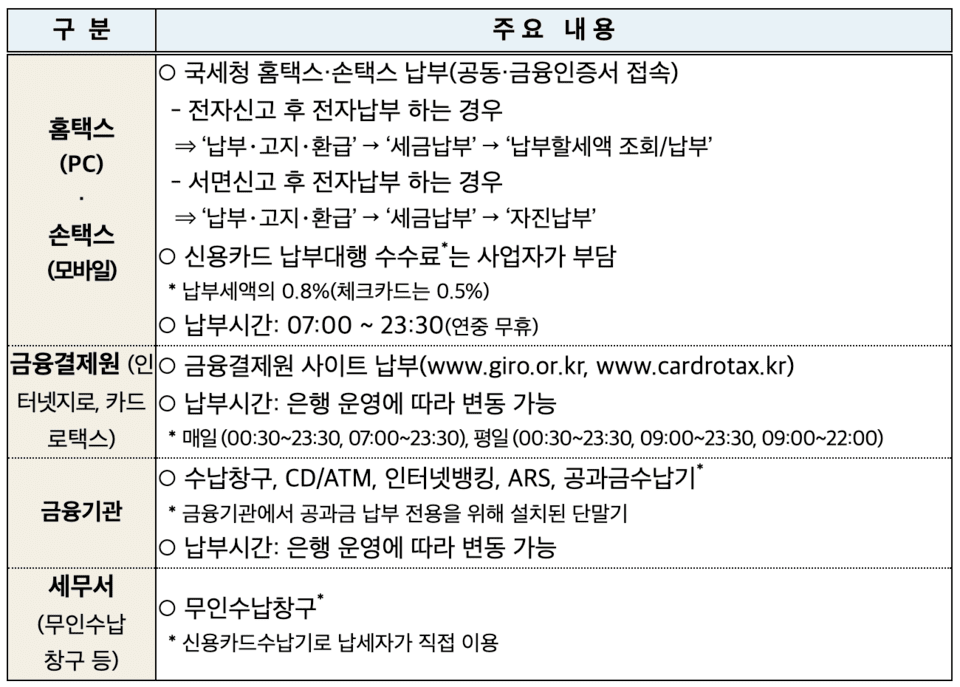

Electronic payments can be made directly through HomeTax or SonTax.

[HomeTax/SonTax] > Payment·Notice·Reimbursement > Tax Payment > View/Pay Due Amount

Payment can be made via credit card or account transfer (credit card fee 0.8%, debit card 0.5%).

Payments can also be made through the Financial Settlement Agency website (Giro, CardroTax) or at bank CD/ATM machines.

Warning: Items that should not be deducted

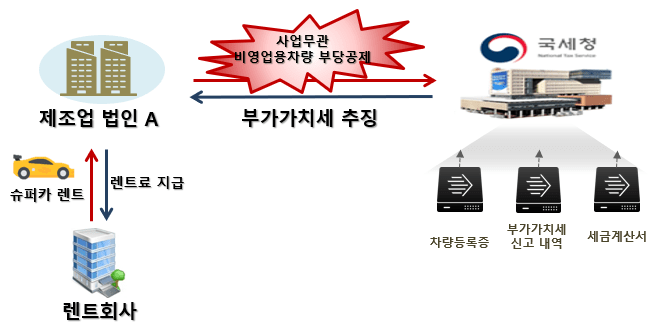

Luxury supercar rental costs and fuel: Not deductible if the vehicle is non-business use.

Legal fees for personal lawsuits of the representative: Costs unrelated to business are not deductible as input tax.

Unreported purchase of residential officetel: Considered omission of sales for tax-exempt use only.

These items are not marked in the report assistance data, so the taxpayer must exclude them directly. If you make a mistake, you will be subject to detailed verification and potential tax retrieval by the National Tax Service post-report.

Additional Important Information

During this value-added tax anticipated reporting and notice period, attention should also be given to early reimbursement, payment deadline extensions, and cases of tax retrieval.

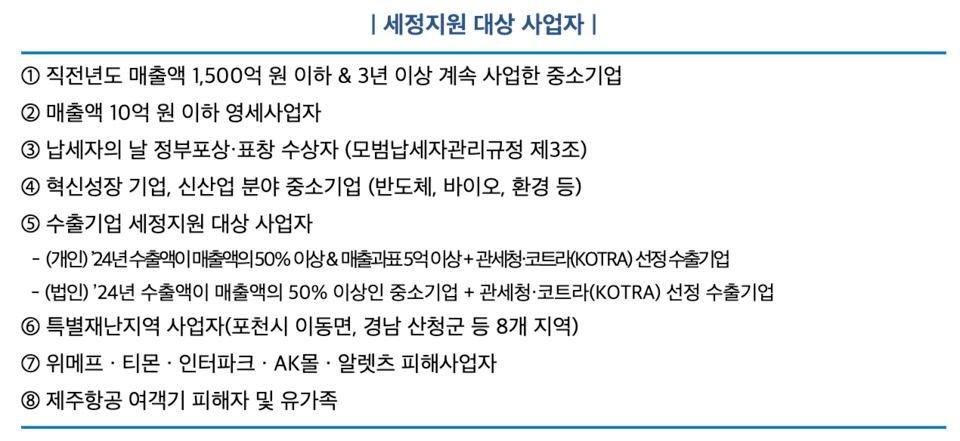

First, early reimbursement is available only for tax support subjects like export companies or small-to-medium enterprises (SMEs). They can apply by April 25 to receive reimbursement by May 2, 8 days earlier than the legal deadline.

The payment deadline can also be extended. Businesses in eight areas, including Sancheong-gun in Gyeongnam, which have been declared as special disaster areas due to forest fires, can benefit from an automatic 2-month extension without separate application. General businesses experiencing operational difficulties can apply for an extension of up to 9 months.

Errors in reporting lead to tax retrieval issues. Last year, the National Tax Service retrieved a total of 35.9 billion won from 2,700 businesses due to incorrect reporting. The average retrieval amount per business was about 14 million won. Most cases where unrelated business expenses were included in the input tax deduction items fall into this category.