The National Tax Service discovered 2,700 business owners who incorrectly reported their value-added tax (VAT) throughout the year 2024, resulting in a total tax collection of 35.9 billion KRW. Each business owner faced an average charge of 14 million KRW. Many of them filed expense items under the assumption that they were eligible for tax deductions, only to be caught during detailed verifications.

The representative cases of tax evasion publicized by the National Tax Service reveal which costs qualify as ‘business-related expenses’ and which are classified as ‘non-deductible items’.

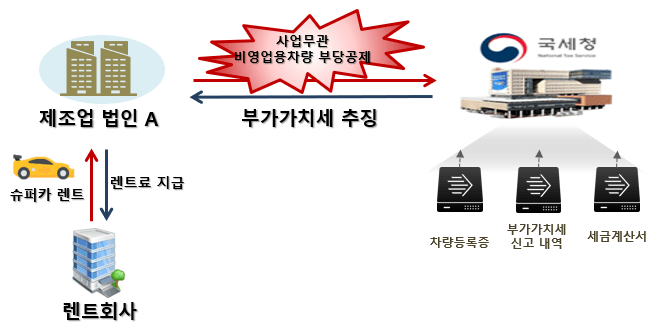

Company A, which runs a manufacturing business, rented a high-end supercar with an engine capacity over 2,000cc. They claimed the rental fees and fuel costs as input tax via tax invoices. However, it was confirmed through the vehicle registration document and rental contract that this was a non-business vehicle, leading to full back taxes and additional fines. If a vehicle is not directly used for business purposes like in the transport industry, rental fees and maintenance costs are not deductible.

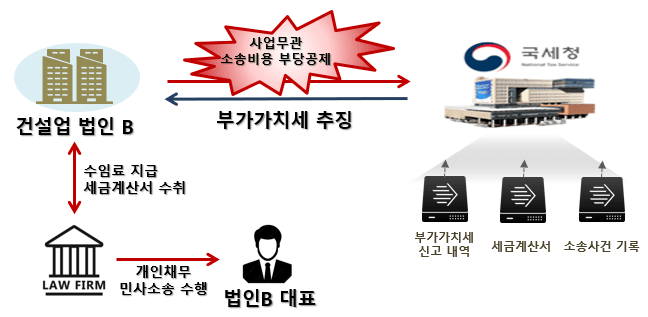

Construction firm B billed legal fees from a law firm for a representative’s personal civil lawsuit as input tax deductions. However, the lawsuit was for personal debt unrelated to the company, leading to total back-tax collection. Legal costs not directly related to business operations are not deductible even with a tax invoice.

Another corporation acquired a golf course membership for entertaining clients and included the acquisition costs in tax deductions. The National Tax Service noted that many usages were personal by the representative, and the business intent was unclear, rejecting it as a ‘business promotion expense’, thus treated as a non-deductible item.

There was also a case where an officetel was purchased or constructed with VAT claimed as a refund, but later found to be used for residential purposes and omitted from taxable sales declarations. Since this was not used for taxable purposes, the necessary sales were not declared, making it subject to enforcement action.

The National Tax Service stated that they continuously monitor repeatedly misreported items with big data analysis. Especially for high-value consumer goods, personal expenditures, and tax-exempt asset uses, there is no guidance in the filing assistance material, requiring extra caution from business owners.

VAT filing is an ‘opportunity for tax savings’, but incorrect filings lead to ‘enforcement actions’. Even if an undue deduction results in a refund, all must be repaid with penalties upon verification. The National Tax Service emphasized that “honest reporting is the best tax-saving strategy”.